Austin Area Metro Rent

In August 2021, according to RentCafe, the average rent is $1,619/month for an average apartment size of 864SF. Rents vary widely by area with Austin. The most expensive neighborhoods in Austin are Clarksville ($2,819), Tarrytown West Austin ($2,819), and Downtown Austin ($2,981). Among the more affordable neighborhoods are Colony Park, and North Point where the average rent is $1,192/mo.

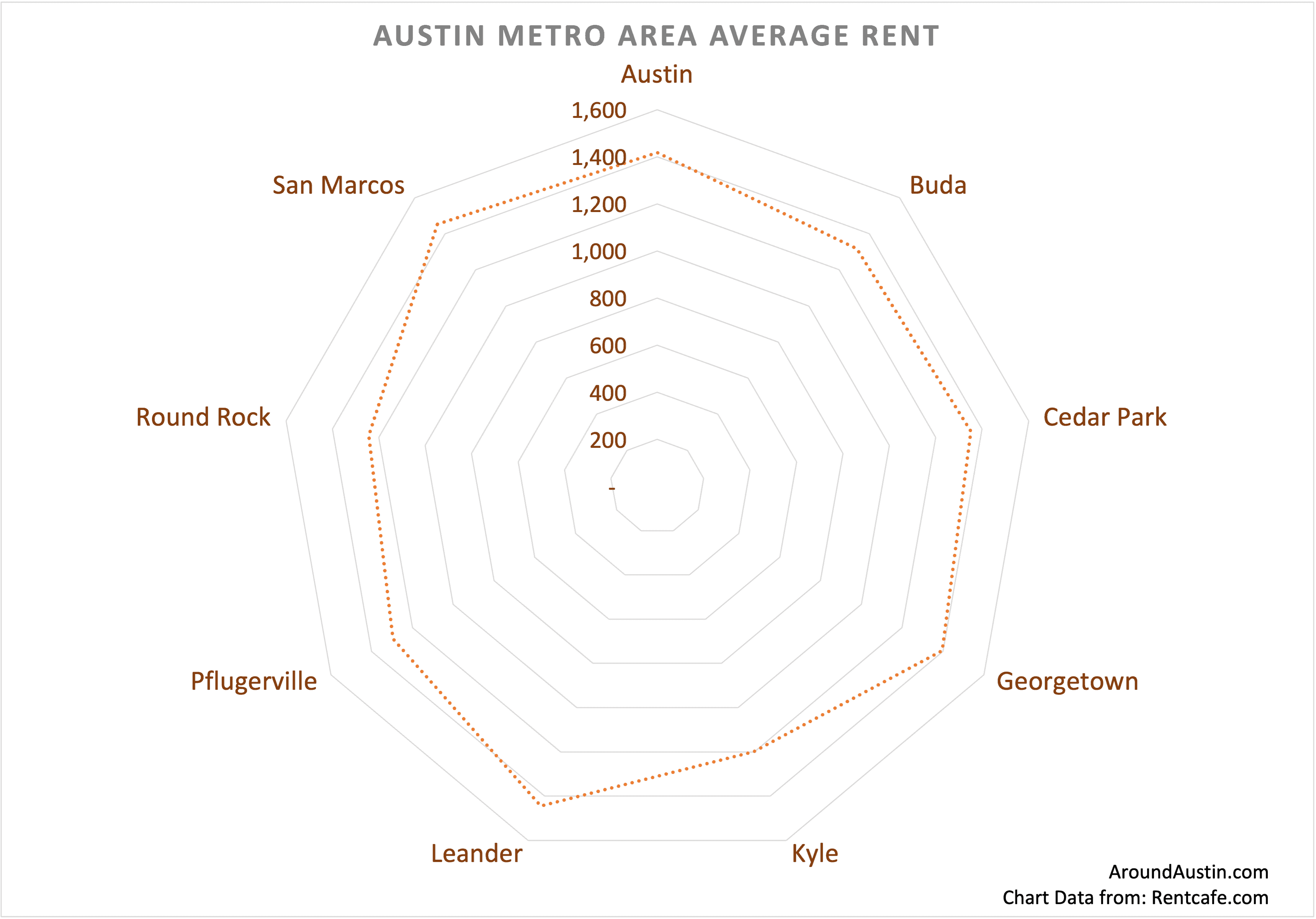

RentCafe also has an earlier survey of rent in Austin suburbs.

| City | Average Rent |

| Austin | 1,417 |

| Buda | 1,317 |

| Cedar Park | 1,351 |

| Georgetown | 1,396 |

| Kyle | 1,199 |

| Leander | 1,444 |

| Pflugerville | 1,295 |

| Round Rock | 1,244 |

| San Marcos | 1,453 |

Austin Southern Neighbors Seeing Dramatic Rent Increases

According to ApartmentData.com’s November Market Line Report, the San Marcos/Kyle/Buda area has been the hottest of Greater Austin’s 11 submarkets over the last three months. And as Austin workers continue to get priced out of the city center and San Marcos’ Hays County continues to grow, the region’s rental submarket has seen 29.1% annualized growth in that time period.

Austin’s southern neighbor cities seeing their own boom from hot housing, rental market – Austonia

Rent prices in Austin have been increasing at the fastest rate ever, according to several data analysts that track this information. The culprit? Experts say the supply of homes and apartments for rent is not keeping up with the number of people who want to live in them.

This imbalance, the effects of which are evident in the for-sale market, means prices have ballooned. While rents in Austin have typically increased by up to 5% each year, this past year they have risen nearly 20%, according to some numbers.

Experts say this demand is fueled by people moving to Austin from out of town. Since 2010, about 32,000 people a year have moved to the city from other parts of the U.S., according to an analysis by the Austin Chamber of Commerce.

Since 2014, a median of about 5,700 new rental units have been added to the city each year. Austin is on track to eclipse that this year; in the first half of 2021, just over 4,000 new homes became available to rent, according to data from Apartment Trends.

“I think that we will complete more units this year than we have ever completed before,” said Charles Heimsath, president of the real estate research firm Capitol Market Research. He also said 2022 could be another record-setting year, with even more apartment complexes finishing construction and more units becoming available to rent.

Single-family home rent up 15% in Austin in September

According to CoreLogic, a property information analytics and data agency, Austin landed in the top five in the single-family rental market with the highest year-over-year rent growth at 15%.

The spike in rent prices for single-family rentals is due to a few factors, including strong job and income growth, competition in for-sale housing and low availability, per the report. Single-family rental vacancy rates remained around 25-year lows in the third quarter of 2021, raising rent prices.

Single-family home rent up 15% in Austin, new report says – KVUE

Council to release more rent assistance

Council members plan to authorize the use of rental assistance dollars through the city’s Housing Authority. The latest $6.6 million also comes from Federal stimulus money and will be provided to vulnerable households through June 30, 2022. The agreement will also include an additional scope of work for marketing and outreach efforts, according to city documents.

Austin City Council approves rent assistance – www.kxan.com

How does Austin’s rent compare to similar cities around the country? Austonia has an article that compares our average rent to San Jose, Seattle, Charlotte, Dallas, Jacksonville, Fort Worth, Columbus, and Indianapolis. Austin has is in the upper quartile–only the west coast cities are more expensive.

Is Austin really that expensive? Here’s how rent stacks up against other major cities – Austonia

As Austin rents reached a record high for the month of September, the ripple effects of a high-demand, low-supply housing and rental market have translated to rapid growth in outer submarkets including San Marcos.